Planning

eMoney and Monte Carlo Analysis

Financial discussions don’t have to be difficult. Nor do the tech solutions that power them. eMoney enables us to deliver innovative, planning-led solutions to empower your financial freedom. This comprehensive financial planning platform is built for the way your financial situation warrants and is designed-to-scale, to meet your evolving financial needs.

In financial planning, we input hundreds of variables, each of which has its own statistical variances or standard deviation. The Monte Carlo process runs projections 10,000+ times, each with a different mix of variable values. It then gives us the likelihood of meeting your goals as a probability, and from there we can see how small changes in your plan affect your likelihood of success.

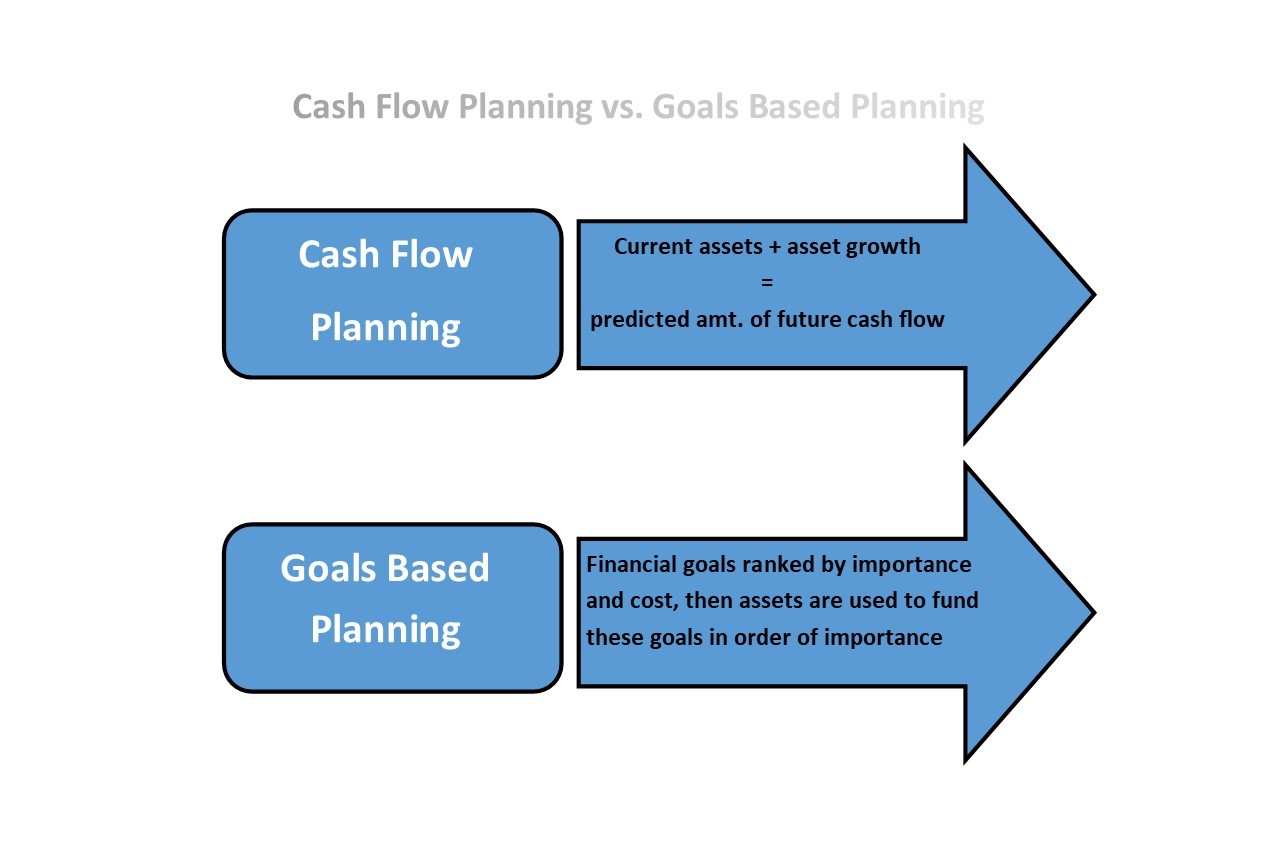

There are two general ways to approach financial planning: cash flow planning and goals based planning.

Cash flow planning

This process takes into account your current assets, how they will grow, and gives you a predicted amount of future cash flow. You then model your future lifestyle based on how much money you will likely have.

Goals based planning

This process focuses on outlining a clear picture of what your financial goals are. These goal are ranked by priority and given an estimated cost. Your assets are then used to fund these goals in order of importance.

We primarily use a goals based approach. We want the focus to be on what you ultimately want to have. This allows us to set clear action items to help you achieve your stated goals. The cash flow planning is worked into our process, as we evaluate the money needed to fund your goals, but the focus is always going to be on what you want to achieve.